How to Understand Auto Policy Quotes and Deductibles delves into the intricate world of insurance, shedding light on the often confusing aspects of policy quotes and deductibles. With a blend of informative insights and practical tips, this guide aims to demystify the complexities surrounding auto insurance, empowering readers to make informed decisions about their coverage.

As we navigate through the nuances of auto policy quotes and deductibles, we'll uncover key components, explore deductible variations, and unravel the intricate web of coverage options. Let's embark on this enlightening journey together.

Understanding Auto Policy Quotes

When looking for auto insurance, understanding policy quotes is crucial to make an informed decision. Here are the key components to consider:

Components of an Auto Policy Quote

- The premium: This is the amount you pay for the coverage provided by the insurance company.

- Deductibles: The amount you agree to pay out of pocket before your insurance kicks in.

- Coverage limits: The maximum amount your insurance will pay for a covered claim.

Impact of Deductibles on Policy Quotes

- Higher deductibles usually result in lower premiums, but you'll have to pay more out of pocket in case of a claim.

- Lower deductibles mean higher premiums, but less financial burden if you need to make a claim.

Factors Influencing Auto Insurance Quotes

- Driving record: A history of accidents or traffic violations can increase your premiums.

- Vehicle type: The make and model of your car can affect the cost of insurance.

- Location: Where you live can impact the risk of theft or accidents, affecting your rates.

Impact of Coverage Options on Policy Quotes

- Adding comprehensive coverage for theft or damage not caused by a collision will increase your premium.

- Choosing higher liability limits can also raise your rates, but provide more protection in case of a lawsuit.

- Opting for uninsured/underinsured motorist coverage can add to your premium but offer additional protection if you're in an accident with an uninsured driver.

Deciphering Deductibles

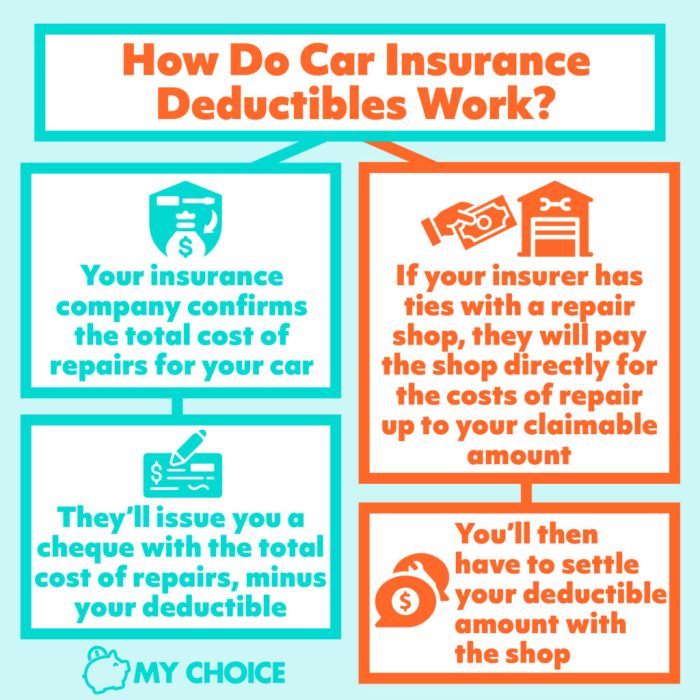

Understanding the concept of deductibles in an auto insurance policy is crucial to making informed decisions about coverage. A deductible is the amount of money you agree to pay out of pocket before your insurance kicks in to cover the rest of a claim.

How Deductibles Work

- When you file a claim for damages to your vehicle, you are responsible for paying the deductible amount first.

- For example, if your deductible is $500 and the total repair cost is $2000, you would pay $500, and your insurance would cover the remaining $1500.

- Choosing a higher deductible typically results in lower monthly premiums, while a lower deductible leads to higher premiums.

Comparing Different Deductible Amounts

- A higher deductible can save you money on premiums but may be riskier if you cannot afford to pay the deductible out of pocket in the event of a claim.

- On the other hand, a lower deductible means higher premiums but less financial burden at the time of a claim.

- Consider your financial situation and driving habits to determine the best deductible amount for your needs.

Choosing the Right Deductible

- Assess your risk tolerance and ability to pay out of pocket in case of an accident.

- Consider the value of your vehicle and how likely you are to file a claim in the future.

- Consult with your insurance provider to understand how different deductible amounts will impact your premiums and coverage.

Comparing Coverage Options

When it comes to auto insurance policies, understanding the different coverage options available is essential to ensure you have adequate protection in case of an accident or other unforeseen events. Below, we will discuss the common coverage options, including liability, collision, and comprehensive coverage, and how they relate to deductibles.

Common Coverage Options

- Liability Coverage: This type of coverage helps pay for damages you cause to others in an accident. It typically includes bodily injury and property damage liability.

- Collision Coverage: Collision coverage helps pay for repairs to your vehicle if you are involved in a collision with another vehicle or object.

- Comprehensive Coverage: Comprehensive coverage protects your vehicle from damages not caused by a collision, such as theft, vandalism, or natural disasters.

Differences Between Coverage Options

- Liability coverage is required by law in most states to cover damages to others, while collision and comprehensive coverage are optional.

- Collision coverage specifically covers damages to your vehicle in a collision, while comprehensive coverage covers a wider range of non-collision related damages.

- Deductibles for collision and comprehensive coverage can vary, affecting your out-of-pocket expenses in the event of a claim.

Coverage Options and Deductibles

- Lower deductibles typically result in higher premiums, while higher deductibles can lower your premiums but increase your out-of-pocket costs in a claim.

- Choosing the right deductible for your coverage options depends on your financial situation and risk tolerance.

Scenarios Illustrating Benefits of Different Coverage Options

- If you live in an area prone to natural disasters, comprehensive coverage can help protect your vehicle from storm damage or flooding.

- Collision coverage is beneficial if you frequently drive in heavy traffic or areas with a high risk of accidents.

- Liability coverage is crucial for protecting your assets in case you are at fault in an accident that causes significant damages to others.

Understanding Policy Terms and Conditions

When it comes to auto insurance, understanding the policy terms and conditions is crucial for making informed decisions. It can be overwhelming to navigate through the complex language used in insurance documents, but breaking down key terms and concepts can help simplify the process.

Key Terms Definition

- Premium:The amount of money you pay to the insurance company for coverage.

- Coverage Limits:The maximum amount your insurance company will pay for a covered claim.

- Exclusions:Specific situations or items that are not covered by your insurance policy.

Impact on Deductible Requirements

Policy terms and conditions can impact your deductible requirements. For example, a policy with higher coverage limits may come with a higher deductible. Understanding these terms will help you choose a policy that aligns with your financial needs and risk tolerance.

Importance of Reading and Understanding

Reading and understanding policy terms and conditions is essential to avoid surprises in the event of a claim. Knowing what is covered, what is excluded, and how much you are responsible for paying out of pocket will help you make informed decisions when selecting an auto insurance policy.

Tips for Interpreting Insurance Jargon

- Take your time to read through the policy document carefully.

- Look up unfamiliar terms or ask your insurance agent for clarification.

- Pay attention to the coverage limits, exclusions, and deductible requirements.

- Consider seeking advice from a trusted financial advisor or insurance professional.

Ending Remarks

In conclusion, understanding auto policy quotes and deductibles is essential for making sound financial decisions when it comes to insurance. By grasping the intricacies of deductibles, coverage options, and policy terms, individuals can navigate the insurance landscape with confidence and clarity.

Armed with this knowledge, readers are better equipped to secure the right coverage that aligns with their needs and budget.

FAQ

What factors can influence the cost of auto insurance quotes?

Factors such as age, driving record, vehicle type, and location can all impact the cost of auto insurance quotes. Insurers also consider credit history and mileage driven annually when calculating premiums.

How do coverage options relate to deductibles?

Coverage options and deductibles are intertwined in auto insurance policies. Higher coverage limits may require higher deductibles, while opting for comprehensive coverage usually involves lower deductibles. Understanding this relationship is crucial for tailoring a policy to individual needs.