Exploring the ins and outs of what is covered and what is not in auto policy quotes, this introduction sets the stage for an informative journey. With a mix of common coverage options and exclusions, readers will gain valuable insights into their auto insurance policies.

In the following paragraphs, we will delve deeper into the specifics of what to expect in most auto policy quotes, shedding light on both inclusions and exclusions.

What Auto Policy Quotes Typically Include

When obtaining auto policy quotes, it is essential to understand the common coverage options that are typically included in most policies. These coverage options play a crucial role in determining the overall cost and protection provided by the policy.

Liability Coverage

Liability coverage is a standard component of auto insurance policies and helps cover costs associated with injuries or property damage to others in an accident where you are at fault.

Collision Coverage

Collision coverage helps pay for repairs to your vehicle in the event of a covered accident, regardless of fault. This coverage is especially important if you have a newer or valuable vehicle.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damages not caused by a collision, such as theft, vandalism, or natural disasters. It provides added peace of mind for unforeseen events.

Uninsured/Underinsured Motorist Coverage

This coverage helps protect you if you are involved in an accident with a driver who has insufficient or no insurance. It covers medical expenses and damages that the at-fault driver's insurance cannot cover.

Additional Coverage Options

In addition to the standard coverages, auto policy quotes may include optional coverage options such as:

- Roadside assistance for emergency services like towing or jump-starts.

- Rental car reimbursement to cover the cost of a rental vehicle while your car is being repaired.

- Gap insurance to cover the difference between your car's value and what you owe on a lease or loan.

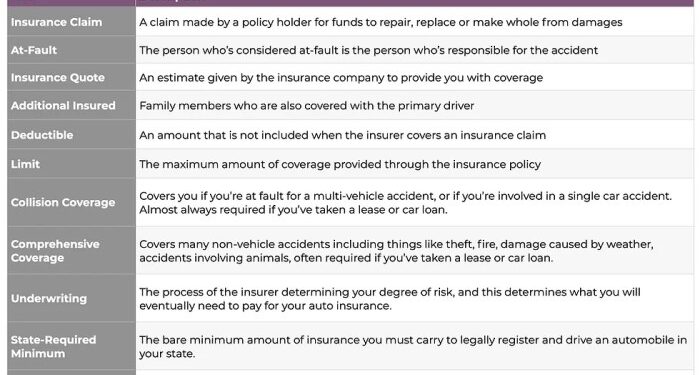

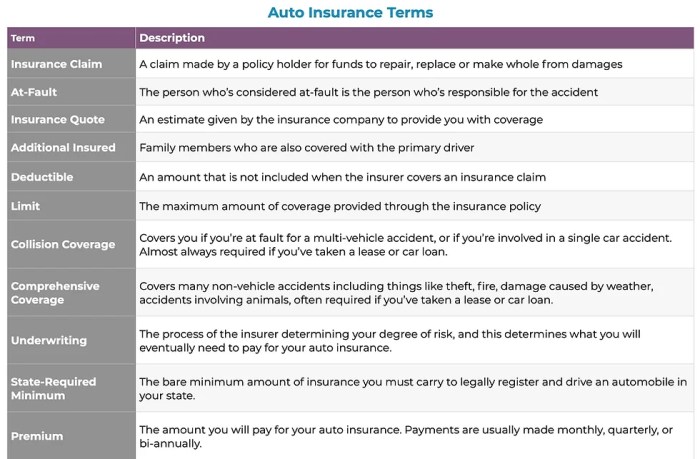

Deductibles and Coverage Limits

Deductibles and coverage limits are important factors that influence auto policy quotes. The deductible is the amount you pay out of pocket before your insurance kicks in, while coverage limits determine the maximum amount your policy will pay for covered losses.

What Auto Policy Quotes Often Exclude

Insurance policies come with certain exclusions that define what is not covered under the policy. Understanding these exclusions is crucial to avoid any surprises when filing a claim. Here are some common exclusions found in most auto policy quotes:

Regular Maintenance, Wear and Tear, and Mechanical Breakdowns

- Regular maintenance such as oil changes, tire rotations, and tune-ups are typically not covered by auto insurance policies.

- Wear and tear on your vehicle, as well as any mechanical breakdowns, are also excluded from coverage.

Intentional Acts, Racing, Using the Vehicle for Hire, and Driving Under the Influence

- Any damage resulting from intentional acts or racing activities is usually not covered by auto insurance.

- If you use your vehicle for commercial purposes or as a taxi, it may not be covered under a standard personal auto policy.

- Driving under the influence of alcohol or drugs may also lead to coverage exclusions in the event of an accident.

Modifications to the Vehicle

- Modifications made to your vehicle, such as aftermarket parts or performance enhancements, may impact your coverage.

- It is essential to inform your insurance provider about any modifications to ensure that your policy adequately covers these changes.

Factors That Influence Auto Policy Quotes

When it comes to determining the cost of auto insurance, several factors play a significant role in influencing the policy quotes. Factors such as age, driving record, location, type of vehicle, and credit score can all impact how much you'll pay for coverage.

Understanding these factors can help you make informed decisions when shopping for auto insurance.

Age

Age is a crucial factor that insurance companies consider when calculating auto policy quotes. Younger drivers, especially those under 25, are typically charged higher premiums due to their lack of driving experience and higher likelihood of being involved in accidents.

On the other hand, older drivers may receive lower rates as they are considered more experienced and less risky.

Driving Record

Your driving record is another key factor that insurance companies take into account. A clean driving record with no accidents or traffic violations can result in lower premiums, as it indicates that you are a safe and responsible driver. On the contrary, a history of accidents, tickets, or DUIs can lead to higher insurance rates.

Location

Where you live can also impact your auto policy quotes. Urban areas with higher rates of accidents and thefts generally have higher insurance premiums compared to rural areas. Additionally, factors such as weather conditions, traffic density, and crime rates in your location can influence the cost of coverage.

Type of Vehicle

The type of vehicle you drive plays a significant role in determining your auto insurance rates. Luxury cars, sports cars, and SUVs are usually more expensive to insure due to their higher repair costs and increased likelihood of theft. On the other hand, modest sedans and minivans are generally cheaper to insure.

Credit Score

Your credit score can also impact the cost of your auto insurance. Insurance companies use credit information to assess your financial responsibility and predict your likelihood of filing a claim. A higher credit score can lead to lower premiums, while a lower credit score may result in higher rates.

Final Wrap-Up

Wrapping up our discussion on what’s typically included and excluded in auto policy quotes, this conclusion encapsulates the key points discussed. From essential coverage options to factors influencing quotes, readers are now equipped with a better understanding of their auto insurance policies.

Top FAQs

What does liability coverage typically include?

Liability coverage usually pays for the other driver's medical expenses and property damage if you're at fault in an accident.

Does auto insurance cover mechanical breakdowns?

No, auto insurance typically does not cover mechanical breakdowns. This falls under regular maintenance and is not considered an insurable event.

Can modifications to my vehicle affect my coverage?

Yes, modifications to your vehicle can impact your coverage. Inform your insurance provider about any changes to ensure you're adequately covered.

How does bundling policies affect auto insurance costs?

Bundling policies, such as combining auto and home insurance, can often lead to discounts on both policies, reducing overall costs.

Are intentional acts covered by auto insurance?

No, intentional acts like causing damage on purpose are typically not covered by auto insurance policies.